You need to assign the SST Tax codes as required.

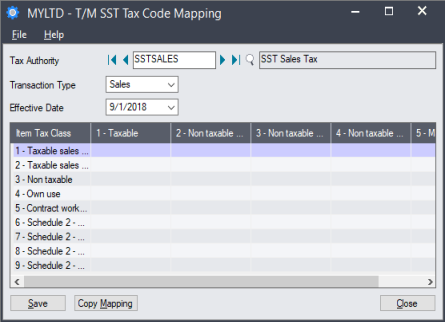

- From Common Services > Malaysia Tax Reports > SST, double-click SST Tax Code Mapping to open the “T/M SST Tax Code Mapping” window.

- In the Tax Authority field, select the Tax Authority for which the tax codes are to be mapped.

- In the Transaction Type field, select Sales to list the Sales tax classes you have created for the selected Tax Authority.

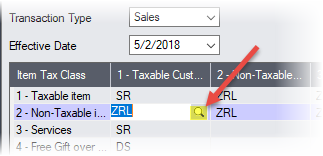

- Double-click on each tax class field and click the Search (

) icon to open the “Finder -Malaysia SST Tax Codes” window.

) icon to open the “Finder -Malaysia SST Tax Codes” window.

- Highlight the required tax code, and click Select to insert it into the tax class field.

Note: You may sometimes need to update the list of SST codes in Sage 300. For more information, see “Updating SST codes”.

Important! Data shown in these images are for illustration purposes only. You should consult your solution provider and a SST consultant on setting up Tax classes tailored to your business model.

- In the Transaction Type field, select Purchases to list the Purchases tax classes that you created for the selected Tax Authority.

- Double-click on each tax class field and click the Search (

) icon to open the “Finder -Malaysia SST Tax Codes” window.

) icon to open the “Finder -Malaysia SST Tax Codes” window. - Highlight the required tax code, and click Select to insert it into the tax class field.