Malaysia Tax Reports (T/M) allows you to enable and set a cut-off date before which any recorded forex gain/loss is not reported in the GST-03 and GAF files.

You can also enter the Sales and Service Tax numbers for the company, and select the inventory items to which SST Tariff Codes are to be assigned.

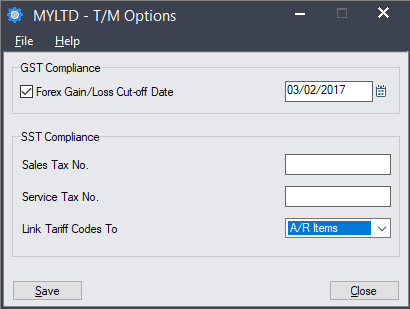

- From Common Services > Malaysia Tax Reports, double-click Options to open the “T/M Options” window.

- To set a Forex cut-off date for GST-03, under GST Compliance, select the Forex Gain/Loss Cut-off Date check box, and enter or click on the calendar icon to select a date.

- Under SST Compliance, enter the company's Sales Tax and Service Tax numbers. In the Link Tariff Codes To field, select whether the SST Tariff codes for the company are to be assigned to Accounts Receivable (A/R) or Inventory Control (I/C) items.

Note: The default setting is A/R Items. If you use Inventory Control, please change this setting to I/C Items.

- Click Save and then Close to save your settings and exit the “T/M Options” window.