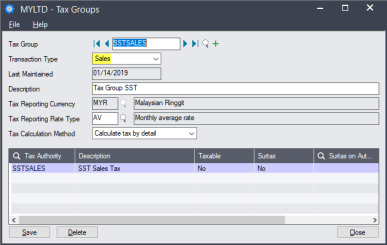

Create sales and purchases tax groups to which you assign tax authorities.

Note: For SST, you must create separate tax groups for Sales Tax and Service Tax.

Note: Defining a tax reporting source currency for multicurrency companies allows you to report taxes in a currency that is different to the customer/vendor currency or the functional currency.

- From Tax Services, click Tax Groups to open the “Tax Groups” window.

- In the Tax Group field, click

to select an existing tax group to edit, or click

to select an existing tax group to edit, or click  to enter a unique code to set up a new group.

to enter a unique code to set up a new group. - In the Transaction Type field, select Sales.

- To use multicurrency accounting, select the Tax Reporting Currency and Tax Reporting Rate Type.

Note: The currency of the Tax Authority must be the same as that of the tax group. All customers and vendors assigned to a tax group must use the same currency as the group.

Note: For SST, the Tax Reporting Rate Type should be set to AV.

- In the Tax Calculation Method field, select the method used by the group to calculate tax.

- Calculate tax by summary. The tax is calculated by multiplying the invoice total by the tax rate.

- Calculate tax by detail. The tax is calculated on each invoice detail, by multiplying the tax base by the tax rate. Select this option for SST.

- In the table, complete the following columns for each Tax Authority.

- If the tax charged by the authority is taxable by another authority lower down in the list, in the Taxable column, type Yes.

- If there is a surtax on the tax amount for the authority, in the Surtax column, type Yes. In the Surtax on Authority column, select the Tax Authority on which the surtax is based.

- In the Transaction Type field, select Purchases, and repeat the above steps.

- Click Save to save your changes to the Tax Group.