To enable reporting of Sales and Service details by Tariff Code in the SST-02 return, you need to create a list of Tariff codes relevant to the business and assign them to either the A/R or I/C inventory items.

Note: A single Tariff Code can be assigned to many items, but each item can have only one Tariff Code.

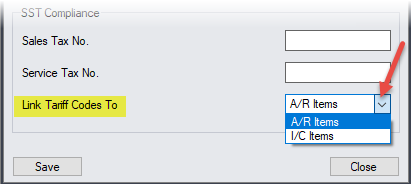

- If you have not yet done so, from Common Services > Malaysia Tax Reports, double-click Options to open the “T/M Options” window. In the Link Tariff Codes To field, select whether the Tariff codes are to be assigned to Accounts Receivable (A/R) or Inventory Control (I/C) items.

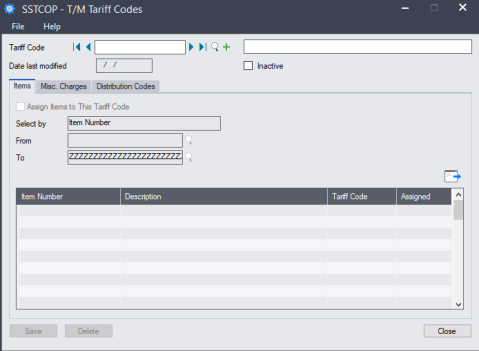

- From Common Services > Malaysia Tax Reports > SST, double-click Tariff Codes to open the “T/M Tariff Codes” window.

- In the Tariff Code field, enter or click

to select an existing Tariff Code, or click

to select an existing Tariff Code, or click  to add a Tariff Code.

to add a Tariff Code. - If required, enter a description of the Tariff Code.

- In the Items tab, select the Assign Items to This Tariff Code check box.

Note: The Items tab is only available if, in the “T/M Options” window Link Tariff Codes To field, you have selected I/C Items.

- In the Select by, From and To fields, enter or select the items to which the Tariff Code is assigned.

Note: To use this with A/R items, your A/R invoices must be Item type invoices.

- Click

and then Yes to assign the Tariff Code to the selected items.

and then Yes to assign the Tariff Code to the selected items.

Note: To remove the Tariff Code assignment, clear the Assign Items to This Tariff Code check box before clicking

.

. - If required, click the Misc Charges tab to assign Tariff codes to O/E Miscellaneous Charges.

- If required, click the Distribution Codes tab to assign Tariff codes to A/R Distribution Codes for use with A/R Miscellaneous Receipts.

- Click Save to save your Tariff Code assignment.